The Russian invasion of Ukraine has significantly impacted food and fuel security in countries in the Middle East and North Africa (MENA), as they are among the top importers of food products from Russia and Ukraine. For instance, in 2021, the Middle East imported over 36 million tons of wheat, most of it coming from Russia and Ukraine, which were the source of almost 30 percent of global wheat imports that year. Many MENA countries import a majority of their fuel from either Russia or Ukraine as well. As the conflict has been raging for over four months, there are concerns about its impacts on the rising costs of fuel and gas. This article offers an overview of the impact the war has had on the MENA region in terms of food security, fuel prices, and vulnerability.

Food security

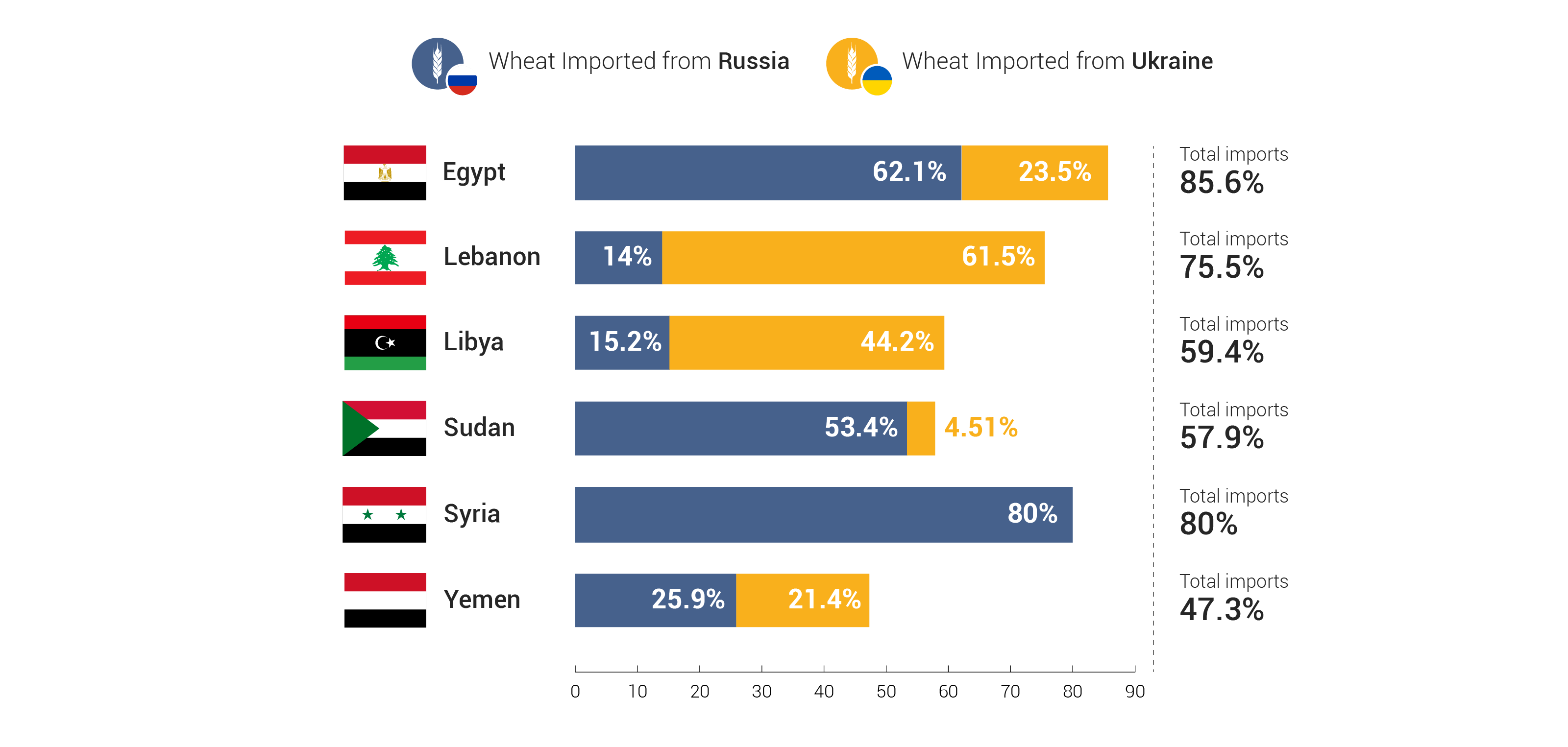

The entire MENA region is particularly impacted by the conflict in Ukraine, as it is heavily reliant on grain imports from both Russia and Ukraine. The MENA region alone is home to 20 percent of the world’s food insecure population, even though it makes up only 6 percent of the global population. Several countries in the region, such as Libya, Yemen, Syria, Egypt, Sudan, and Lebanon are particularly vulnerable due to existing crises that predate the Russian invasion.

Egypt, the world’s largest wheat importer, received about 80 percent of its wheat from Russia and Ukraine before the war. Since then, Egyptian authorities have been urgently seeking to diversify their sources of wheat. As part of this effort, Supply Minister Aly Moselhy announced at the end of June that the country had enough wheat secured for six months, after securing 180,000 tons from India, even though that deal fell short of the originally planned 500,000 tons. Egypt also highly relies on wheat to provide subsidized bread to more than 60 million people, and with a worsening economic crisis, the pressure is mounting. In addition to wheat, Egypt previously imported half of its sunflower oil from Ukraine.

In May 2022, Egypt reportedly turned away two Russian-flagged ships carrying what was believed to be stolen Ukrainian wheat. The two ships were seen unloading their content in Syrian ports later in June. Syria relies on Russia for most of its wheat; yet, at the end of 2021, Russia suspended an agreement to export 1 million tons to the country because of its already-rising global cost. Even before the invasion of Ukraine, it was estimated that there would be a 2 million ton shortage in wheat in Syria, exacerbating an already precarious situation.

Lebanon imports over 60 percent of its wheat supply from Ukraine. Since mid-June, bakeries have seen droves of people standing in long lines due to an ongoing shortage of subsidized flour. Between February and mid-June alone, the price of subsidized bread increased by 18 percent. In addition, the capacity of the country to store wheat has been greatly reduced after the Beirut port explosion heavily damaged the port’s grain silos in August 2020.

Sudan imports 90 percent of its wheat from Russia and the country has seen a 60 percent drop in exports since the Russian invasion of Ukraine. This year, local producers were forecasted to produce 25 percent of the country’s needs in wheat, but with the worsening economic crisis and the freezing of international aid after the October 2021 military coup, the Sudanese authorities have not bought all of this season’s harvest, leaving thousands of farmers with surplus wheat that threatens to rot.

Other MENA countries that are heavily reliant on imports of key food products include Libya with its imports of vegetables and wheat products from Russia and Ukraine, and Yemen which is heavily reliant on food imports, specifically grains, from Ukraine.

Fuel and minerals

Russia is the largest exporter of oil, globally exporting 2.85 million barrels per day, and is one of the largest producers of coal and natural gas. Many countries around the world are dependent on Russia’s fossil fuel industry. Although Europe and China are the biggest consumers of Russian energy exports, many MENA countries are heavily impacted by the increasing price and decreased availability of Russian oil. Moreover, Russia is a major exporter of fertilizers, and a disruption in the supply chain will increase input costs for this year’s harvest season, further driving up food costs. Fertilizer prices are already 78 percent higher than they were in 2021. However, several Arab countries—particularly Morocco and Jordan—produce and export fertilizers, and stand to benefit from rising prices as they work to bolster their outputs and provide the region with alternatives.

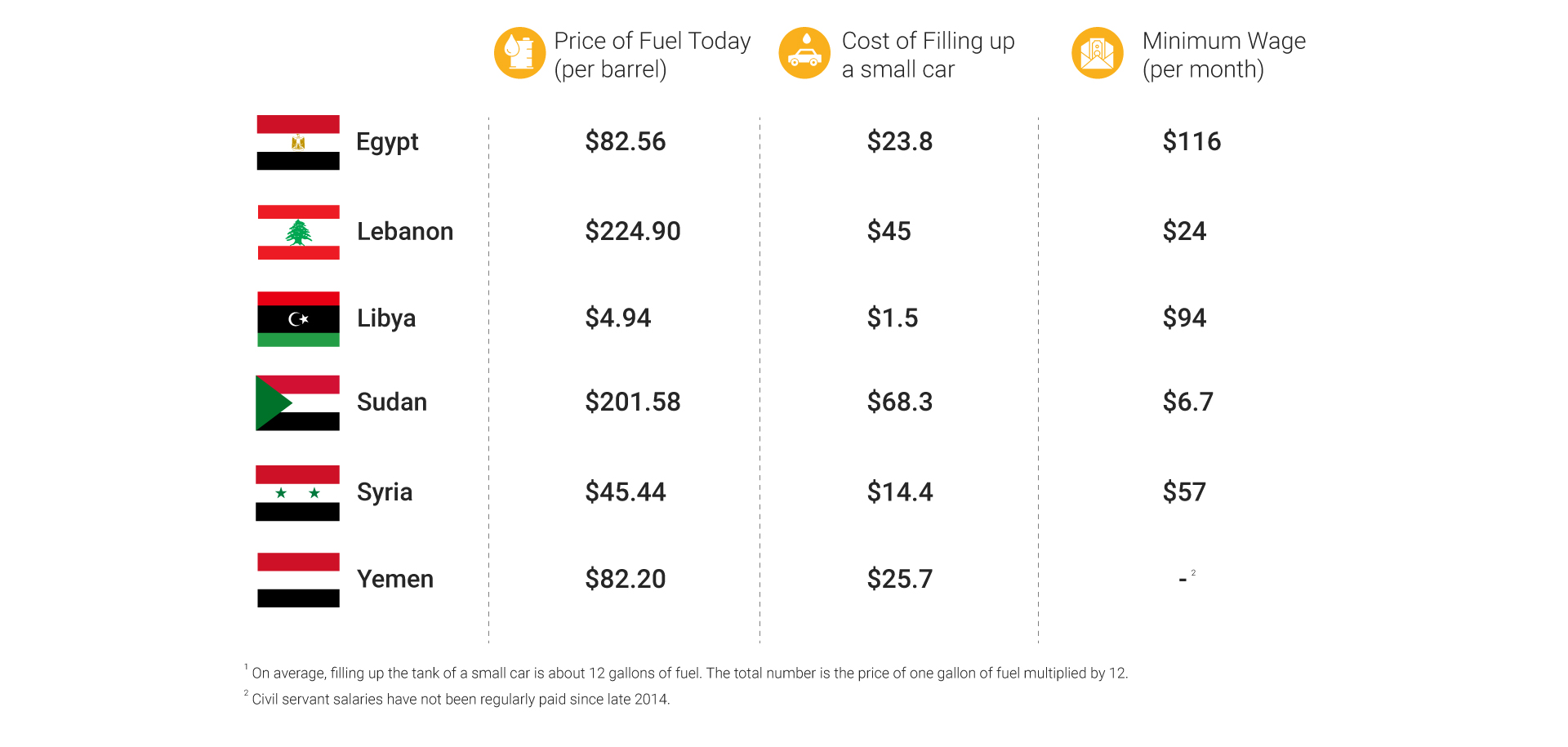

Studies have shown that fluctuations in oil prices directly impact food prices, as they affect the cost of transportation, insurance, and goods, in addition to the foods themselves. They can also lead to supply chain disruptions that can fracture already-fragile economies. All price increases are transferred to the consumers, shrinking their purchasing power. Salaries in many countries across MENA barely cover a families’ basic needs and any increase in fuel costs results in food products becoming inaccessible and unaffordable for many. This has clear negative consequences for people’s health and disproportionately impacts women and children.

Lebanon is particularly vulnerable to this sharp increase in energy prices, as the state imports all of its oil and gas needs, and any price shift directly impacts the price of commodities; this is particularly harmful to the population at a time when inflation is high and people are reeling from a catastrophic financial crisis. The cost of 20 liters of fuel crossed the country’s minimum wage in June. Although Libya is an oil-rich state, due to infrastructure constraints, it is unable to produce enough refined fuel to meet its consumption, making it vulnerable to global price increases. As a major fuel importer, fuel prices across Yemen have sharply increased since April.

Vulnerable populations

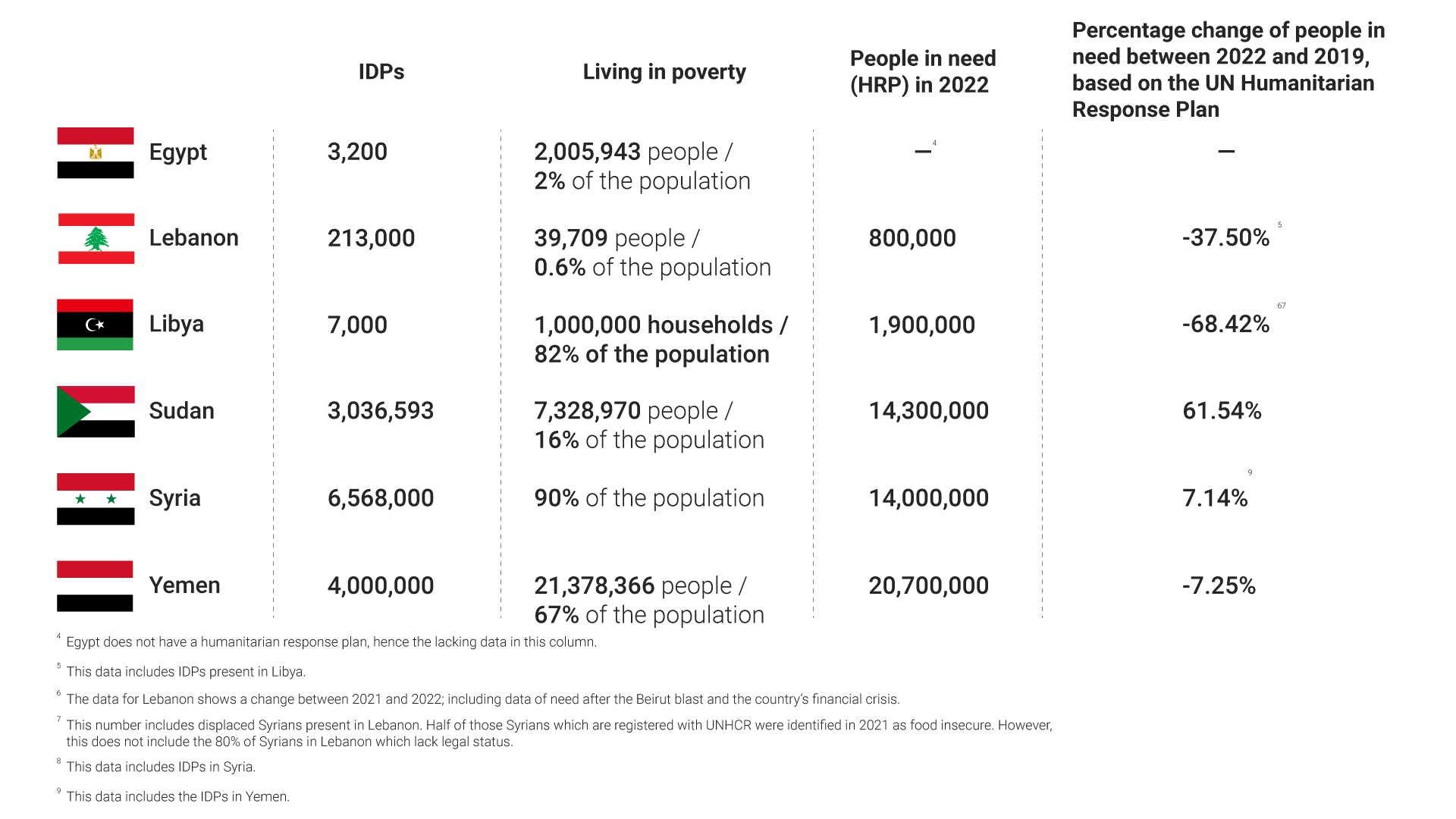

There are populations particularly vulnerable within the MENA countries hit by this crisis. Egypt is in a precarious situation as most of its population (88 percent) are registered in the government bread rationing system to receive subsidized bread. Similarly, Lebanon is in a catastrophic economic and humanitarian situation, with 82 percent of the population living in poverty.

Two countries with some of the most sizable populations of vulnerable communities are Yemen and Syria. Yemen has over 4 million internally displaced people (IDPs) and 67 percent of its population is living in poverty. Syria has over 6.5 million IDPs and 90 percent of its population is living in poverty. For these countries, impact on food security and fuel costs is significant and felt acutely by already-vulnerable populations. For instance, food prices in Syria were already 37 percent higher in April 2022 than in February, just one month into the war in Ukraine. In addition, the World Food Program’s (WFP) assistance to 6 million individuals in Yemen will be reduced to 55 percent of their caloric needs between July and December 2022 if they do not manage to raise enough funding.

Conclusion and policy recommendations

The conflict in Ukraine has had a detrimental impact on already vulnerable countries in the MENA region. This impact could be mitigated by responses from other wheat-producing countries and additional assistance from humanitarian and food-assistance international organizations.

- Procurement of grains is a challenge but even when food items are secured, storing them can be an obstacle. Lebanon’s only wheat silo was destroyed in the Beirut blast in August 2020. Lebanon used to store three to four months of supplies in that silo, but now can only store up to one month’s supply in the country’s second largest city, Tripoli. There is an urgent need to explore alternatives to Russian and Ukrainian food supplies but it is equally necessary to identify and locate workarounds for storing these supplies.

- To respond to the impacts of the World Food Program’s two main global wheat exporters being in conflict, and with Ukraine’s export ban on many food items, other wheat producing countries such as the United States and Canada should respond by increasing their exports to WFP.

- The UN-authorized cross-border aid mechanisms to Syria, under Security Council Resolution 2585 expired on July 10, 2022. At present, the mechanism allows aid access through a singular border crossing: the Bab al-Hawa crossing between Turkey and northwest Syria. Given the conflict’s impact on food security, the Security Council must consider a more sustainable, consistent, and less politicized mechanism to ensure regular access to all populations in need across Syria.

- Donors have to prioritize fully funding the Humanitarian Response Plans (HRP) in the region to prevent a further deterioration in living conditions. Additionally, donor governments should find ways to absorb the increases in food prices to prevent UN agencies, like the WFP, and NGOs from decreasing food rations to already-vulnerable populations.

- The conflict in Ukraine has exposed the deep global reliance on fossil fuels. Donor states should take this as an opportunity to support the diversification of energy sources and increase reliance on renewable energy for countries in the global south which face significant impacts from the fuel shortages.

- Many of the countries which are particularly vulnerable in terms of food security and fuel shortages following the conflict in Ukraine have sanctions imposed on them by other states and international organizations, including Syria, Sudan, and Yemen. Sanction-imposing countries must clarify to private financial institutions, importers, and insurance companies that grain imports are not restricted.

- In order to reduce dependency on imported wheat, which results from droughts and other climate change-related challenges, climate resilience programming must be increased.

Special thanks to Programs and Events Intern Yasmeen Abed and Legal and Policy Intern Issraa Faiz for research support.